Key Takeaways

- The payback period is the length of time it takes to recover the cost of an investment or the length of time an investor needs to reach a breakeven point.

- Shorter paybacks mean more attractive investments, while longer payback periods are less desirable.

- The payback period is calculated by dividing the amount of the investment by the annual cash flow.

How to calculate the payback period in Excel with formula?

Payback period Formula = Total initial capital investment /Expected annual after-tax cash inflow. Let us see an example of how to calculate the payback period when cash flows are uniform over using the full life of the asset. Example: A project costs $2Mn and yields a profit of $30,000 after depreciation of 10% (straight line) but before tax of ...

How do you calculate payback period for project?

How do you calculate payback period? To determine how to calculate payback period in practice, you simply divide the initial cash outlay of a project by the amount of net cash inflow that the project generates each year. For the purposes of calculating the payback period formula, you can assume that the net cash inflow is the same each year.

What are the advantages of using payback period?

The main advantages of payback period are as follows:

- A longer payback period indicates capital is tied up.

- Focus on early payback can enhance liquidity

- Investment risk can be assessed through payback method

- Shorter term forecasts

- This is more reliable technique

- The calculation process is quicker than and simple than any other appraisal techniques

- This is a very easily understood concept

What is the regular payback period is defined as?

Payback Period Definition. Payback period can be defined as period of time required to recover its initial cost and expenses and cost of investment done for project to reach at time where there is no loss no profit i.e. breakeven point.

What is payback period?

Why is the payback period shorter?

What is the ROI formula?

Does the payback period show the return on investment?

See 1 more

About this website

How do I calculate payback period?

To calculate the payback period you can use the mathematical formula: Payback Period = Initial investment / Cash flow per year For example, you have invested Rs 1,00,000 with an annual payback of Rs 20,000. Payback Period = 1,00,000/20,000 = 5 years.

What is payback period with example?

The payback period is expressed in years and fractions of years. For example, if a company invests $300,000 in a new production line, and the production line then produces positive cash flow of $100,000 per year, then the payback period is 3.0 years ($300,000 initial investment ÷ $100,000 annual payback).

What is payback period in financial management?

The payback period is the time required to recover the initial cost of an investment. It is the number of years it would take to get back the initial investment made for a project.

What is the payback period formula in Excel?

First, input the initial investment into a cell (e.g., A3). Then, enter the annual cash flow into another (e.g., A4). To calculate the payback period, enter the following formula in an empty cell: "=A3/A4" as the payback period is calculated by dividing the initial investment by the annual cash inflow.

How do you calculate payback period PDF?

The payback period is the cost of the investment divided by the annual cash flow.

Is payback period calculated after depreciation?

In simple words, depreciation means reducing the value of any goods or asset with time, and it is typically measured in percentage. However, depreciation does not mean the loss of value in terms of cash. Hence, add the depreciation back to the payback period equation.

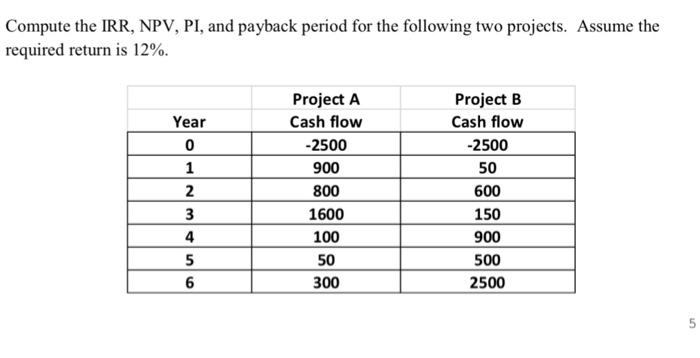

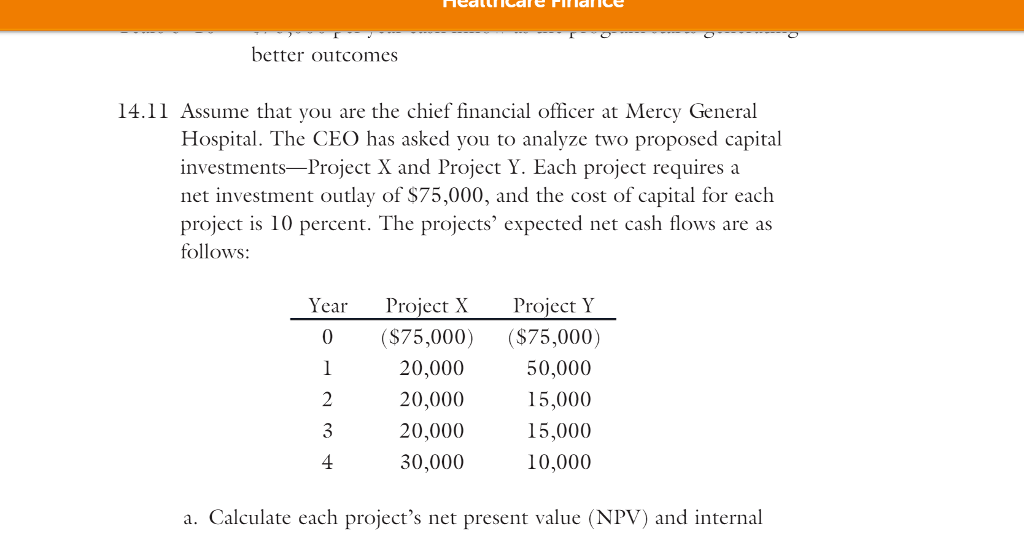

How do you calculate the payback period of two projects?

To determine how to calculate payback period in practice, you simply divide the initial cash outlay of a project by the amount of net cash inflow that the project generates each year. For the purposes of calculating the payback period formula, you can assume that the net cash inflow is the same each year.

How do you calculate discounted payback period and payback period?

Calculating the Discounted Payback Period This can be done using the present value function and a table in a spreadsheet program. Next, assuming the project starts with a large cash outflow, or investment to begin the project, the future discounted cash inflows are netted against the initial investment outflow.

Is 2 years a good payback period?

Broadly, the consensus is: For B2C businesses, a payback period of less than 1 month is GREAT, 6 months is GOOD, and 12 months is OK.

What is the difference between NPV vs payback?

NPV (Net Present Value) is calculated in terms of currency while Payback method refers to the period of time required for the return on an investment to repay the total initial investment. Payback, NPV and many other measurements form a number of solutions to evaluate project value.

What is payback period analysis?

The Payback Period shows how long it takes for a business to recoup an investment. This type of analysis allows firms to compare alternative investment opportunities and decide on a project that returns its investment in the shortest time if that criteria is important to them.

Why is a payback period important?

The payback period is the time it will take for a business to recoup an investment. Consider a company that is deciding on whether to buy a new machine. Management will need to know how long it will take to get their money back from the cash flow generated by that asset.

What is payback period advantages and disadvantages?

Payback period advantages include the fact that it is very simple method to calculate the period required and because of its simplicity it does not involve much complexity and helps to analyze the reliability of project and disadvantages of payback period includes the fact that it completely ignores the time value of ...

How do you calculate payback period from months and years?

Payback period Formula = Total initial capital investment /Expected annual after-tax cash inflow. Let us see an example of how to calculate the payback period when cash flows are uniform over using the full life of the asset.

What is the difference between payback period and break even point?

A company's payback period is concerned with the number of periods needed to pay back an initial investment with positive net income, while a company's breakeven point is concerned with the specific period in which its revenue will equal total costs and its net income will be zero.

What is payback period analysis?

Print. Payback period is the time required for positive project cash flow to recover negative project cash flow from the acquisition and/or development years. Payback can be calculated either from the start of a project or from the start of production.

What Is the Payback Period?

The term payback period refers to the amount of time it takes to recover the cost of an investment. Simply put, the payback period is the length of time an investment reaches a break-even point. People and corporations invest their money mainly to get paid back, which is why the payback period is so important. In essence, the shorter payback an investment has, the more attractive it becomes. 1 Determining the payback period is useful for anyone (regardless of whether they're individual investors or corporations) and can be done by taking dividing the initial investment by the average net cash flows. 2

Why is a payback period favored?

Payback period is favored when a company is under liquidity constraints because it can show how long it should take to recover the money laid out for the project. If short-term cash flows are a concern, a short payback period may be more attractive than a longer-term investment that has a higher NPV.

When Would a Company Use the Payback Period for Capital Budgeting?

The payback period is favored when a company is under liquidity constraints because it can show how long it should take to recover the money laid out for the project. If short-term cash flows are a concern, a short payback period may be more attractive than a longer-term investment that has a higher NPV.

Why is a simple payback period favorable?

For this reason, the simple payback period may be favorable, while the discounted payback period might indicate an unfavorable investment.

Why do analysts favor the payback method?

Some analysts favor the payback method for its simplicity. Others like to use it as an additional point of reference in a capital budgeting decision framework. The payback period does not account for what happens after payback, ignoring the overall profitability of an investment.

How long is the payback period for a mortgage?

For example, the payback period on a mortgage can be decades while the payback period on a construction project may be 5 years or less.

How long does it take to get a payback?

Conversely, the longer the payback, the less desirable it is. For example, if solar panels cost $5,000 to install and the savings are $100 each month, it would take 4.2 years to reach the payback period.

What is a Payback Period?

The payback period is the amount of time it will take to recoup the initial cost of an investment, or to reach its break-even point. This is one of the most important calculations for investors when planning investments and returns. It can help investors decide between different investments that may have a lot of similarities, as they’ll often want to choose the one that will pay back in the shortest amount of time.

Why is it important to calculate payback period?

Calculating payback periods is especially important for startup companies with limited capital that want to be sure they can recoup their money without going out of business. Companies also use the payback period to select between different investment opportunities or to help them understand the risk-reward ratio of a given investment.

Why is the payback period shorter?

Another limitation of the payback period is that it doesn’t take the time value of money (TVM) into account. The time value of money is the idea that cash will be worth more in the future than it is worth today, due to the amount of interest that it can generate. Not only does this apply to the initial capital put into an investment, but it’s also important because as an investment generates returns, that cash can then be reinvested into something else that earns interest or income. This is another reason that a shorter payback period makes for a more attractive investment.

Why is a shorter payback period important?

Not only does this apply to the initial capital put into an investment, but it’s also important because as an investment generates returns, that cash can then be reinvested into something else that earns interest or income. This is another reason that a shorter payback period makes for a more attractive investment.

What is the difference between a short period and a long period?

A short period means the investment breaks even or gets paid back in a relatively short amount of time by the cash flow generated by the investment, whereas a long period means the investment takes longer to recoup. How investors understand that period will depend on their time horizon.

What happens if you lock money in an investment without earning a return?

The longer money remains locked up in an investment without earning a return, the more time an investor must wait until they can access that cash again, and the more risk there is of losing the initial investment capital.

Is the payback period a long term investment?

The calculation only looks at the time period up until the initial investment will be recouped. It doesn’t consider the earnings the investment will bring in after that, which may either be higher or lower, and could determine whether it makes sense as a long-term investment.

How to calculate payback period?

Steps to Calculate Payback Period 1 The first step in calculating the payback period is determining the initial capital investment and 2 The next step is calculating/estimating the annual expected after-tax net cash flows over the useful life of the investment.

What is a payback period?

Payback period can be defined as period of time required to recover its initial cost and expenses and cost of investment done for project to reach at time where there is no loss no profit i.e. breakeven point.

Why is the payback period important?

The length of the project payback period helps in estimating the project risk. The longer the period, the riskier the project is. This is because the long-term predictions are less reliable.

When cash flows are not uniform over the use full life of the asset, then the cumulative cash flow from operations must be?

When cash flows are NOT uniform over the use full life of the asset, then the cumulative cash flow from operations must be calculated for each year. In this case, the payback period shall be the corresponding period when cumulative cash flows are equal to the initial cash outlay.

Does depreciation add up to cash inflow?

While calculating cash inflow, generally, depreciation is added back as it does not result in cash out flow.

How to calculate payback period?

The payback period is the amount of time required for cash inflows generated by a project to offset its initial cash outflow. There are two ways to calculate the payback period, which are: 1 Averaging method. Divide the annualized expected cash inflows into the expected initial expenditure for the asset. This approach works best when cash flows are expected to be steady in subsequent years. 2 Subtraction method. Subtract each individual annual cash inflow from the initial cash outflow, until the payback period has been achieved. This approach works best when cash flows are expected to vary in subsequent years. For example, a large increase in cash flows several years in the future could result in an inaccurate payback period if using the averaging method.

How long is ABC International's payback period?

The net annual positive cash flows are therefore expected to be $40,000. When the $100,000 initial cash payment is divided by the $40,000 annual cash inflow, the result is a payback period of 2.5 years.

How long does it take to payback a $100,000 initial expenditure?

In this case, we must subtract the expected cash inflows from the $100,000 initial expenditure for the first four years before completing the payback interval, because cash flows are delayed to such a large extent. Thus, the averaging method reveals a payback of 2.5 years, while the subtraction method shows a payback of 4.0 years.

What is the payback period formula?

The payback period formula is used to determine the length of time it will take to recoup the initial amount invested on a project or investment. The payback period formula is used for quick calculations and is generally not considered an end-all for evaluating whether to invest in a particular situation.

How often does a payback period match?

The result of the payback period formula will match how often the cash flows are received . An example would be an initial outflow of $5,000 with $1,000 cash inflows per month. This would result in a 5 month payback period. If the cash inflows were paid annually, then the result would be 5 years.

How long is the payback period for a $10,000 investment?

If $10,000 is the initial investment and the cash flows are $1,000 at year one, $6,000 at year two, $3,000 at year three, and $5,000 at year four, the payback period would be three years as the first three years are equal to the initial outflow.

Does investment X return the initial investment?

However, investment X will only return the initial investment whereas investment Y will eventually pay double the initial investment. Given the additional information not provided by the payback period formula, one may consider investment Y to be preferable.

Does the period payback factor in the time value of money?

Another issue with the formula for period payback is that it does not factor in the time value of money. The time value of money concept, as it applies to the payback period formula, proposes that each future cash flow is worth less when compared to today's value. The discounted payback period formula may be used instead to consider ...

How to calculate payback period?

Calculating the payback period by hand is somewhat complex. Here is a brief outline of the steps, with the exact formulas in the table below (note: if it's hard to read, right-click and view it in a new tab to see full resolution): 1 Enter the initial investment in the Time Zero column/Initial Outlay row. 2 Enter after-tax cash flows (CF) for each year in the Year column/After-Tax Cash Flow row. 3 Calculate cumulative cash flows (CCC) for each year and enter the result in the Year X column/Cumulative Cash Flows row. 4 Add a Fraction Row, which finds the percentage of remaining negative CCC as a proportion of the first positive CCC. 5 Count the number of full years the CCC was negative. 6 Count the fraction year the CCC was negative. 7 Add the last two steps to get the exact amount of time in years it will take to break even.

What is the payback period?

The payback period is the amount of time (usually measured in years) it takes to recover an initial investment outlay, as measured in after-tax cash flows. It is an important calculation used in capital budgeting to help evaluate capital investments .

What are the advantages and disadvantages of using payback period?

The main advantage of the payback period for evaluating projects is its simplicity. A few disadvantages of using this method are that it does not consider the time value of money and it does not assess the risk involved with each project. Microsoft Excel provides an easy way to calculate payback periods.

How long does it take to get your initial investment back?

For example, if a payback period is stated as 2.5 years, it means it will take 2½ years to receive your entire initial investment back.

What is the advantage of the payback period?

The main advantage of the payback period for evaluating projects is its simplicity.

Why is it important to evaluate a project by its payback period?

One primary advantage of evaluating a project or an asset by its payback period is that it is simple and straightforward. Basically, you're asking: "How many years until this investment breaks even?" It is also easy to apply across several projects. When analyzing which project to undertake or invest in, you could consider the project with the shortest payback period.

Can three projects have the same payback period?

For example, three projects can have the same payback period; however, they could have varying flows of cash. Without considering the time value of money, it is difficult or impossible to determine which project is worth considering. Also, the payback period does not assess the riskiness of the project.

What is the payback period?

Payback period, which is used most often in capital budgeting, is the period of time required to reach the break-even point (the point at which positive cash flows and negative cash flows equal each other, resulting in zero) of an investment based on cash flow.

Why is payback period important?

Due to its ease of use, payback period is a common method used to express return on investments, though it is important to note it does not account for the time value of money. As a result, payback period is best used in conjunction with other metrics.

Why is a discounted payback period useful?

Discounted payback period is useful in that it helps determine the profitability of investments in a very specific way: if the discounted payback period is less than its useful life (estimated lifespan) or any predetermined time, the investment is viable.

What is positive cash flow?

Positive cash flow that occurs during a period, such as revenue or accounts receivable means an increase in liquid assets. On the other hand, negative cash flow such as the payment for expenses, rent, and taxes indicate a decrease in liquid assets. Oftentimes, cash flow is conveyed as a net of the sum total of both positive ...

How long does it take to pay back a $2,000 investment?

For instance, a $2,000 investment at the start of the first year that returns $1,500 after the first year and $500 at the end of the second year has a two-year payback period. As a rule of thumb, the shorter the payback period, the better for an investment.

What is discounted cash flow?

Discounted cash flow (DCF) is a valuation method commonly used to estimate investment opportunities using the concept of the time value of money, which is a theory that states that money today is worth more than money tomorrow.

What is the purpose of the payback period and the discounted payback period?

Both the payback period and the discounted payback period can be used to evaluate the profitability and feasibility of a specific project.

What is a discounted payback period?

What is the Discounted Payback Period? The discounted payback period is a modified version of the payback period that accounts for the time value of money. Time Value of Money The time value of money is a basic financial concept that holds that money in the present is worth more than the same sum of money to be received in the future.

What are the disadvantages of a discounted payback period?

One of the disadvantages of discounted payback period analysis is that it ignores the cash flows after the payback period. Thus, it cannot tell a corporate manager or investor how the investment will perform afterward and how much value it will add in total. It may lead to decisions that contradict the NPV analysis.

How to find percentage of time left over after project has been paid back?

Next, we divide the number by the year-end cash flow in order to get the percentage of the time period left over after the project has been paid back.

What is payback period?

Given its nature, the payback period is often used as an initial analysis that can be understood without much technical knowledge. It is easy to calculate and is often referred to as the “back of the envelope” calculation. Also, it is a simple measure of risk, as it shows how quickly money can be returned from an investment.

Why is the payback period shorter?

In some ways, a shorter payback period suggests lower risk exposure, since the investment is returned at an earlier date.

What is the ROI formula?

ROI Formula (Return on Investment) Return on investment (ROI) is a financial ratio used to calculate the benefit an investor will receive in relation to their investment cost. It is most commonly measured as net income divided by the original capital cost of the investment. The higher the ratio, the greater the benefit earned.

Does the payback period show the return on investment?

While the payback period shows us how long it takes for the return on investment, it does not show what the return on investment is. Referring to our example, cash flows continue beyond period 3, but they are not relevant in accordance with the decision rule in the payback method.